Content Contributed by:

By: Steve Christenson, CHSP, CIP, CISP, Executive Vice President, Ascensus

As summer comes to a close, employers are in the midst of selecting next year’s benefit options for both themselves and their employees. They’re deciding whether to offer retirement plans, health insurance plans, and other types of benefits, such as flexible savings accounts and health savings accounts (HSAs). It is the HSA part of this equation that we need to take a closer look at. HSAs can be a critical element of an individual’s entire financial plan. Very few savings arrangements offer the same advantages as HSAs—tax-deductible contributions, tax-deferred earnings, and tax-free distributions if used properly. This HSA triple tax advantage is extremely attractive, and it is one reason that financial organizations offer HSA programs. Even so, many financial organizations continue to ask the question: “Should we offer this to our clients—and if so, what are the service and education considerations?”

Why do individuals open HSAs?

To answer this question, it’s important to understand that many individuals open their first HSA through their employer as part of open enrollment. Employers will generally select a health insurance provider and use the suggested HSA provider that is paired with the insurance plan. This may make it easier for employees to open an HSA and for the employer to make contributions. And knowing that they can receive an HSA contribution from their employer may further encourage employees to open an HSA.

Can an individual have multiple HSAs?

It’s common for employers to periodically change health insurance and HSA providers. This may require an employee to open an HSA with the new HSA provider. When this occurs, the employee holding the original HSA may wonder what will happen next.

The answer—possibly nothing. Because the employee is the HSA owner, he can keep the HSA open even if he’s not contributing to it. And all prior HSA contributions belong to the HSA owner—regardless of the source. Although the employee may keep the original HSA open, the employer will likely stop covering any fees associated with the original HSA. This may subject the employee to minimum balance requirements and fees. The employee may choose to

- continue using the original HSA in combination with the new HSA, but be subject to potential fees;

- roll over or transfer the assets from the original HSA to the new HSA or to another HSA that he owns elsewhere (similar to rolling over IRA assets);

- pay for outstanding qualified medical expenses or reimburse himself for past qualified medical expenses paid out of pocket; or

- distribute assets in the original HSA to pay for nonqualified expenses (these distributions would be subject to tax and a possible penalty tax).

To help individuals determine their best option, financial organizations should consider whether the average consumer will know about these options or know where to find the answers. While information can be found either through an HSA provider or through other websites, it’s hard to know if individuals will seek this information, interpret it correctly, and make a decision that is in their best interest. This scenario continues to compound every time an employer changes to a new benefit provider.

What else should financial organizations consider?

Financial organizations should consider the following key takeaways.

First—it’s ok if clients have multiple HSAs. If your organization has a relationship with area businesses, you can work with local employers to provide an HSA solution that allows employers and employees to maintain an HSA with your organization, regardless of which health insurance provider the employer is using. Your organization could coordinate with employers and their employees to establish a long-term HSA relationship either by establishing a new HSA or by consolidating other HSAs that employees may have with other HSA providers. Your organization is already a trusted and known resource in the community, so when your clients are looking for the best way to save for their current and future medical expenses, and for retirement in general, take some time to educate them about the benefits of having an HSA. Providing objective, accurate information is one of the best ways to build a trusting, long-term relationship with your clients.

Second—don’t underestimate the HSA market. Many financial organizations have questioned whether they should enter the HSA market. As in previous years, HSAs continue to enjoy enormous growth. According to the 2021 Devenir and HSA Council Demographic Survey, there were over 32 million HSAs covering 67 million people at the end of 2021. The survey also reported that 1 in 5 Millennials had an HSA as of December 31, 2021. This demographic is quickly replacing Baby Boomers in the labor force, which provides the perfect opportunity for your organization to help these individuals transition to an HSA.

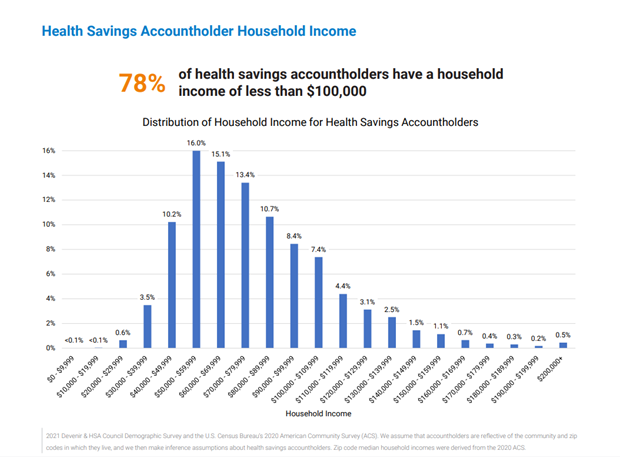

There’s a common misconception that HSAs benefit only wealthy individuals. But HSAs are used by individuals in every income range. For example, the following chart shows that 78 percent of HSA owners have a household income of less than $100,000, and 45 percent have income between $50,000 and $80,000. HSAs can also help these individuals create future wealth and financial stability during retirement.

Third—it’s still important to focus on Baby Boomers and Gen Xers. According to the previously mentioned survey, HSA owners age 50 and older hold almost $53 billion in HSA assets.

Many individuals believe that they can no longer have an HSA once they retire and enroll in Medicare. This is not true: even though individuals can’t contribute to an HSA once they enroll in Medicare, they can still benefit from having an HSA by

- reimbursing themselves for qualified medical expenses previously paid out of pocket,

- paying for certain Medicare premiums, and

- continuing to pay for qualified medical expenses.

How can HSAs help retired individuals?

HSAs should be considered part of the overall asset portfolio for long-term retirement planning. According to a 2019 CNBC study, a healthy 65-year old couple retiring in 2019 will need approximately $390,000 to cover health-care expenses. HSAs can play an integral role in paying for these expenses. And it’s not just health-care expenses that retirees need to worry about. Individuals still need to pay for normal, everyday expenses (e.g., food, utilities) after they retire. Luckily, once HSA owners turn 65, they can take taxable, but penalty-free HSA distributions to pay for nonqualified expenses.

Summary

As you review these points, consider how your organization can help the community by building new relationships and strengthening existing relationships with local businesses. HSAs can provide an affordable solution to your organization and to your clients. And while starting a new HSA program can seem daunting, especially if you have limited staff, you don’t have to do it alone. Ascensus offers multiple services—including document, administration, and consulting services. Contact your Ascensus sales representative today to learn more about this amazing opportunity.